Many lenders lack confidence in traditional credit reporting sources

75% of lenders believe that traditional credit data and scores don't deliver the complete picture of a consumer’s creditworthiness.

59% of lenders have turned to using forms of alternative data in their underwriting process.

Empower lending with robust analysis.

Here’s how it works:

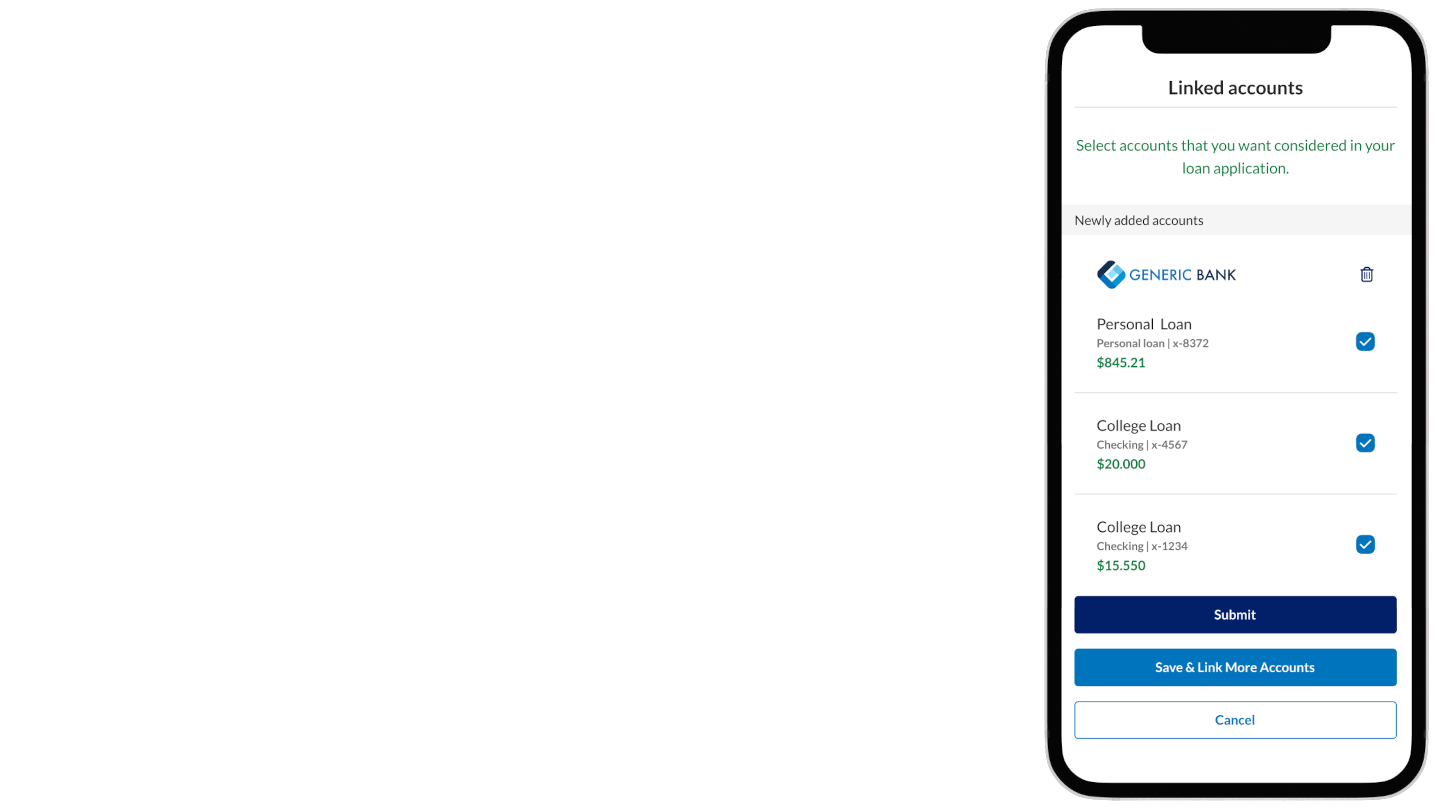

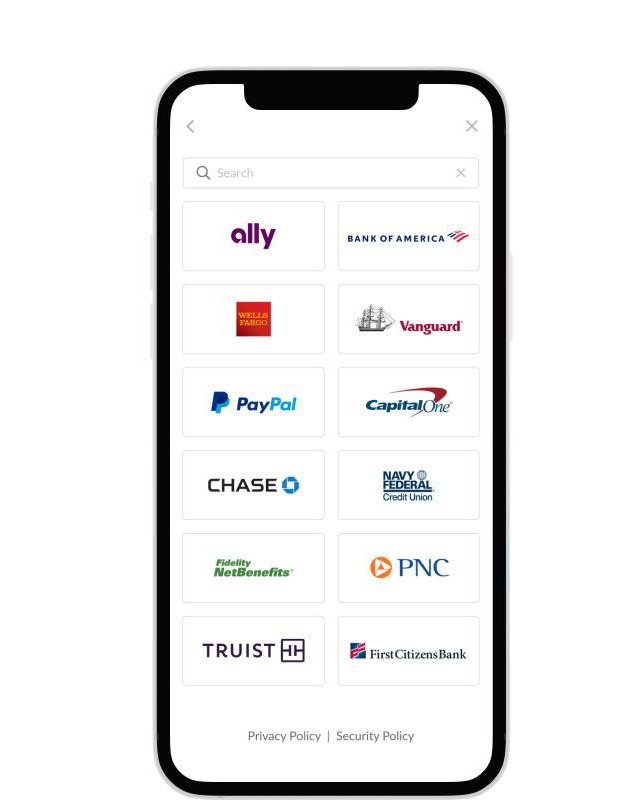

Integrate with Credit Matrix so your user can add and link their financial accounts.

Your user grants permission and links their financial accounts.

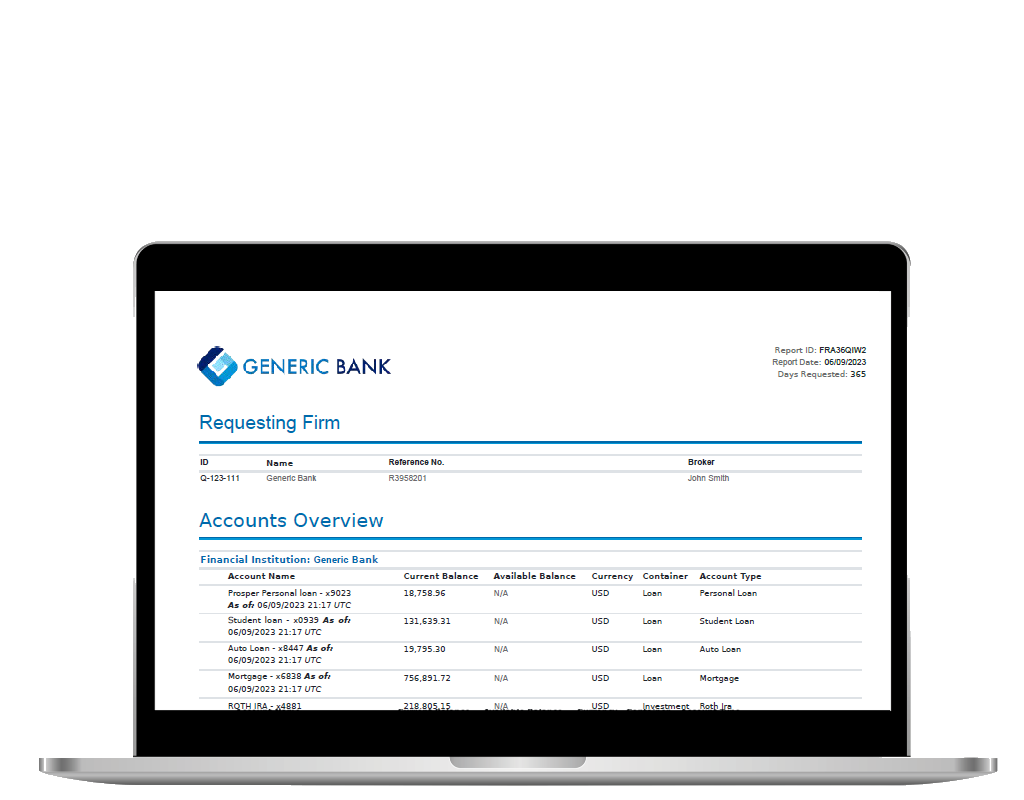

You receive a holistic report via a PDF or data extract format.

Key benefits

• A more holistic view of each applicant based on user selected data.

• Up-to-date account information for quicker, deeper visibility and better risk decisions.

• Uncover new credit-worthy consumers with insights not available with traditional credit reporting sources.

Linking Accounts, Simplified.

Credit & Lending

With Yodlee Credit LLC proven technology, banks and FinTechs can quickly aggregate, categorize,

and display consumer income and expense analysis for faster more accurate lending decisions.

Holistic View

Get an accurate view of an applicant’s financial position from aggregated account data.

Quick & Reliable Results

Digital data retrieval and analysis reduce manual errors, cut operational costs, and reduce decision times.

Expense & Income Analysis

Income and expense summaries for responsible lending decisions.

Up to Date Picture

Current financial account data is aggregated and analyzed for an up-to-date view.

Data Enrichment

Income, expenses, and transfers are categorized and enriched for deep and clear insights.

Trusted Provider

Yodlee combines local and global expertise, with over 20 years globally.