Product Guide

Introduction to Open Banking

Open Banking (OB) is a financial directive in the EU and the UK starting September 2019. Under OB, users can grant or withhold permission to share their account data with authorised third-party providers (TPP) such as Yodlee. It enables customers to use TPP to help manage their finances. The data is shared via Application Programming Interfaces (APIs). With the advent of Open Banking, any financial institution that has implemented the standard categorizes financial accounts into OB-supported and non-OB-supported account types.

Getting Started with UK Open Banking

Yodlee provides two different engagement models to allow your users to connect and share their account information with your application:

- Registered AISP service:

If you have your own FCA AISP license or wish to apply for one, the following steps apply:- With your FCA AISP permissions, enroll in the Open Banking Directory.

- Sign up for a Yodlee Developer account, and be on the Engage pricing tier or above.

- Configure your application and generate an unsigned certificate.

- Generate your Open Banking certificates at the Open Banking Directory.

- Onboard payment account providers:

- Dynamic providers are registered automatically.

- Manual Providers need to be registered on demand and on per provider basis by providing Client-id and Client-secret.

- Yodlee AISP service:

If you are a UK entity and you don’t have your own FCA AISP license, you can apply to use Yodlee’s extended AISP license service. You will be requested to submit your application, and a Yodlee representative will contact you and guide you through the eligibility process.

Account Aggregation through FastLink

FastLink for aggregating financial institutions supports payments and non-payment account types through Open Banking. The user can choose from different supported account types when selecting a provider. Currently, only payment-enabled accounts can be aggregated with Open Banking, whereas all the other account types are aggregated using the user's banking credentials. If a user is attempting to link an Open Banking-supported account type, the user is required to provide consent to share account information with Yodlee FastLink.

Consent to Share Account Data

If a user attempts to link a provider that requires their consent to share account information with Yodlee, they will be asked to provide consent before continuing with the provider linking flow.

Consent to share must be re-granted for each application that supports Yodlee FastLink at the financial institution provider. For example, a user grants consent to share data with Yodlee FastLink from a link on the financial institution's home page.

Step 1: Selecting a Provider

Users can search for providers in the search field that appears by default at the top of the screen or select other providers by tapping an icon on the page corresponding to the provider they want to add. When a user selects a provider that requires the user to grant permission to share data (Open Banking), the application provides a path for the user to aggregate Open Banking-supported accounts in addition to other types of accounts that can be aggregated by providing online banking credentials.

Applies to both Registered AISP and Yodlee AISP service model.

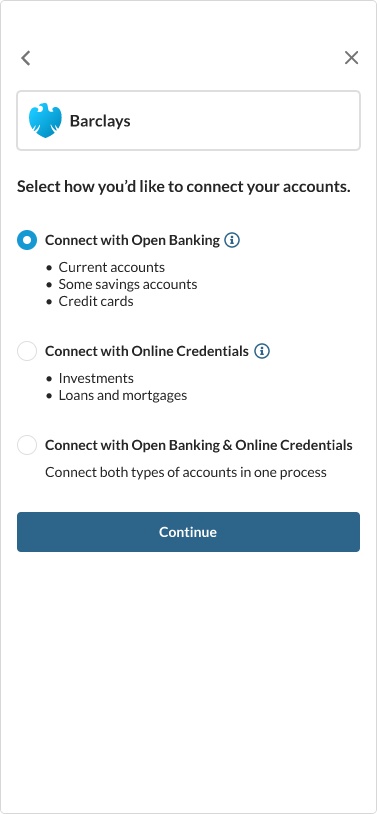

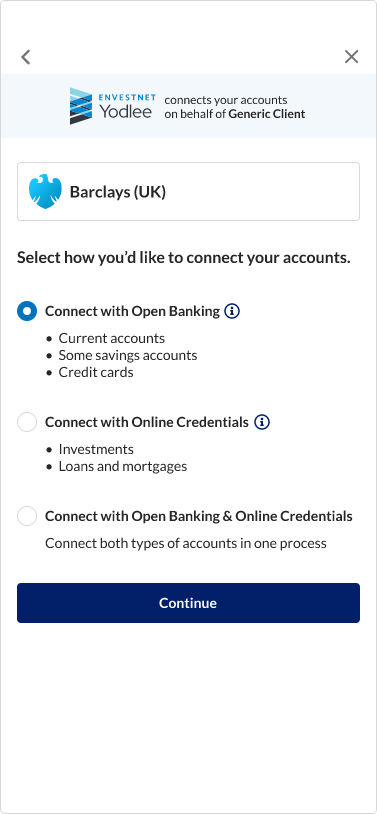

Step 2: Choose the Type of Account

On this screen, users must select the type of accounts they wish to connect, whether Open Banking or online credentials.

Registered AISP

Yodlee AISP

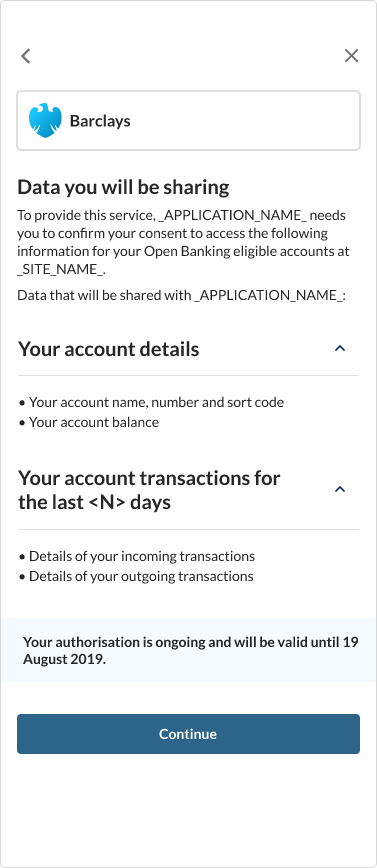

Step 3: Provide Consent

In the Consent screen, the user is required to provide his consent to share his account details for a specific period with the client’s application. If the user had already added the selected provider in the past, the Consent screen displays a message at the top of the screen indicating that the user had already aggregated this provider/account, and the process is repeated.

Registered AISP

Yodlee AISP

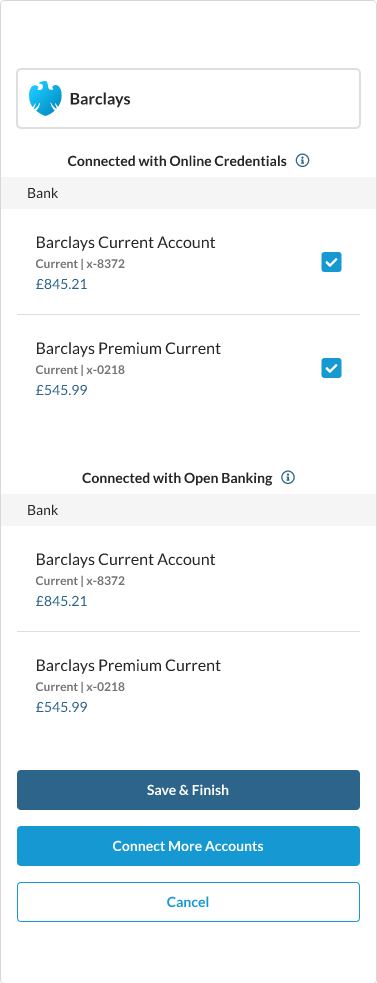

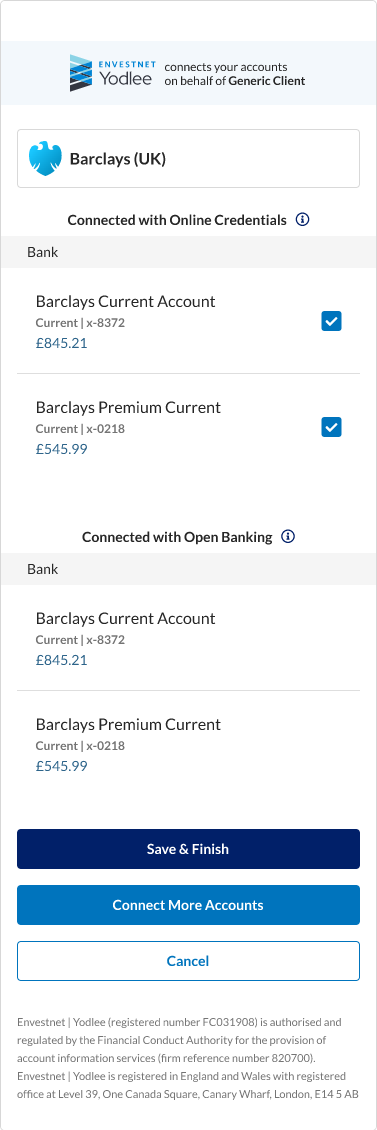

Step 4: View Accounts

The following account attributes are displayed for each aggregated account in the view accounts screen under the appropriate financial institution and container heading:

- Account Name – Name of the account (for example, ABC Checking)

- Account Number – The account number (masked except for the last four digits)

- Account Type – Account type at the investment provider (Savings, checking, 401k, etc.).

- Account Balance – Balance of funds in the account

The Save & Finish button closes FastLink, whereas the Connect More Accounts button redirects the user back to select a provider screen in FastLink so that they can add another provider if they choose to.

Registered AISP

Yodlee AISP

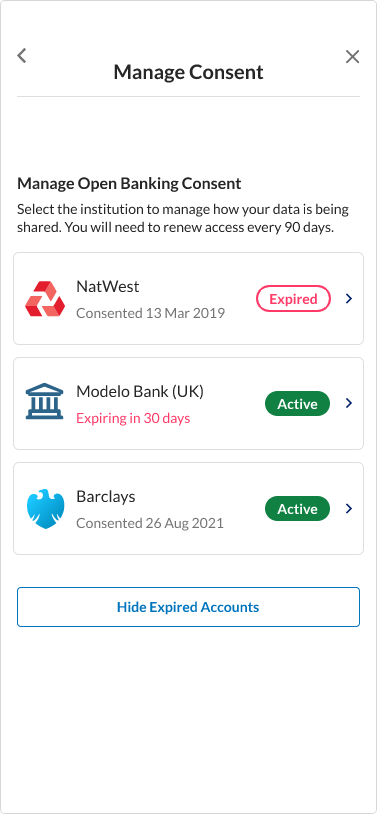

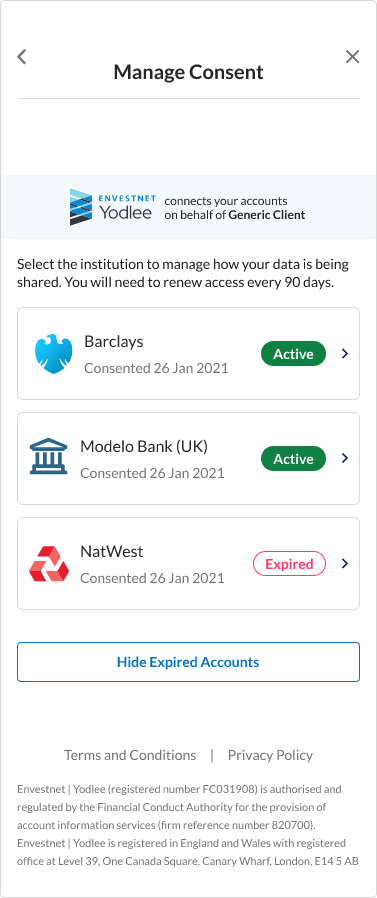

Manage Consent

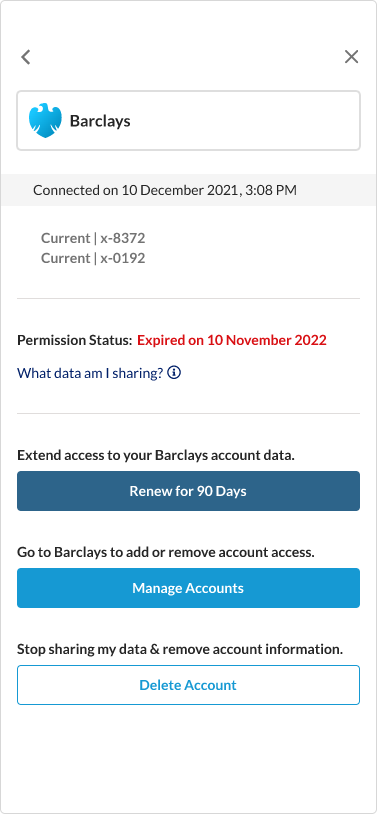

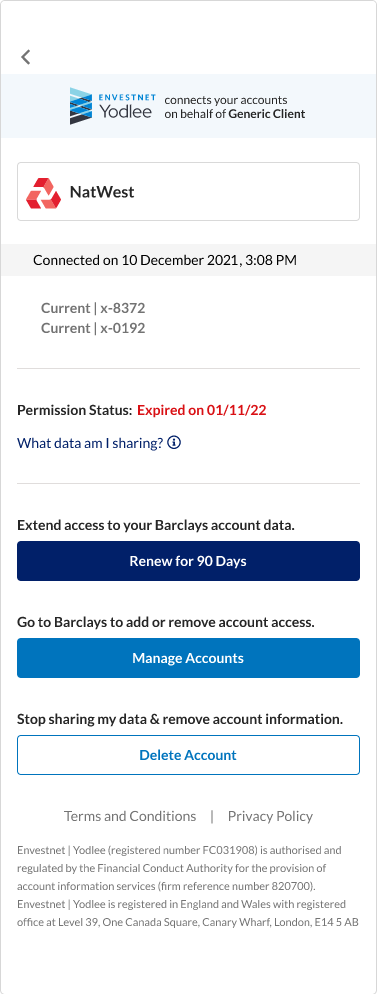

The Manage Consent screen in FastLink facilitates a consolidated view of all user consents for aggregated accounts. The user can renew or delete their existing consent to share account data (for the providers that require the users' consent). When launching Fastlink, the Manage Consent screen can be invoked by passing the manageConsent value in the flow extra parameter attribute.

Registered AISP

Yodlee AISP

Renew Consent to Share Data

After successfully linking a consent-required provider, the user will be asked to renew their consent periodically. By default, the frequency required to renew consent is 90 days for UK Open Banking.

The user might choose to renew consent if:

- The selection of accounts has changed at the financial institution.

OR - The consent is about to expire at the provider and must be renewed.

Yodlee FastLink lets users re-authenticate and renew their authorization to share their account information with Yodlee. The user can invoke the consent renewal flow by invoking the Manage Consent screen and selecting the required consent from the listed consents. The consent status applicable at that moment is displayed against each listed consent.

Registered AISP

Yodlee AISP

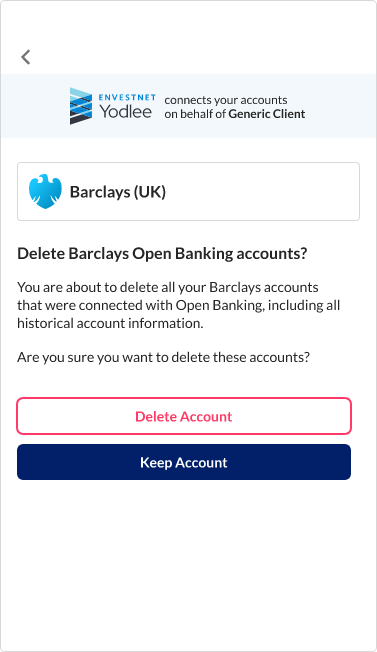

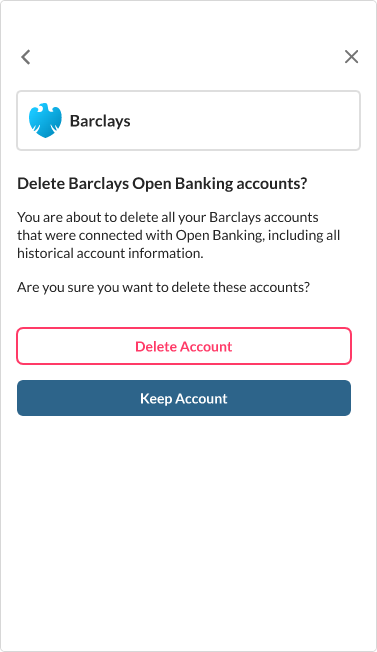

Delete Consent to Share Data

The user can delete consent by tapping the Delete Account, available only on the consent detail screen that can be invoked from the Manage Consent screen. The delete option is available when the consent is active and if the consent has expired or is about to expire. The provider for which consent is deleted will no longer appear in the Manage Consent screen. The financial institution or provider is notified that the user has deleted the consent to share account information.

Registered AISP

Yodlee AISP