Yodlee APIs – New Features/Enhancements

Associating Real-estate Account with Loan Account

The update account service is now enhanced to link a real-estate account with a loan account by passing account ID of the loan account in the linkedAccountIds field. The get account service will return the association of the linked loan accounts in the real-estate account response.

| API URLs: |

JAVA SDK Enhancements and Bug Fixes

- Enhancements -

- HTTP library is updated to 4.8.0.

- The SDK is updated to accommodate changes mentioned for Yodlee APIs.

- Bug fix -

Get Net Worth Summary Service –

The get net worth summary API service currently does not consider accounts marked asincludeInNetWorth=falsefor the net worth calculation, even if the account ID is explicitly passed in the accountId query parameter.

The API service has been enhanced to consider all accounts that are passed in theaccountIdquery parameter irrespective of theincludeInNetWorth=falseflag.API URL:

FastLink – New Features/Enhancements

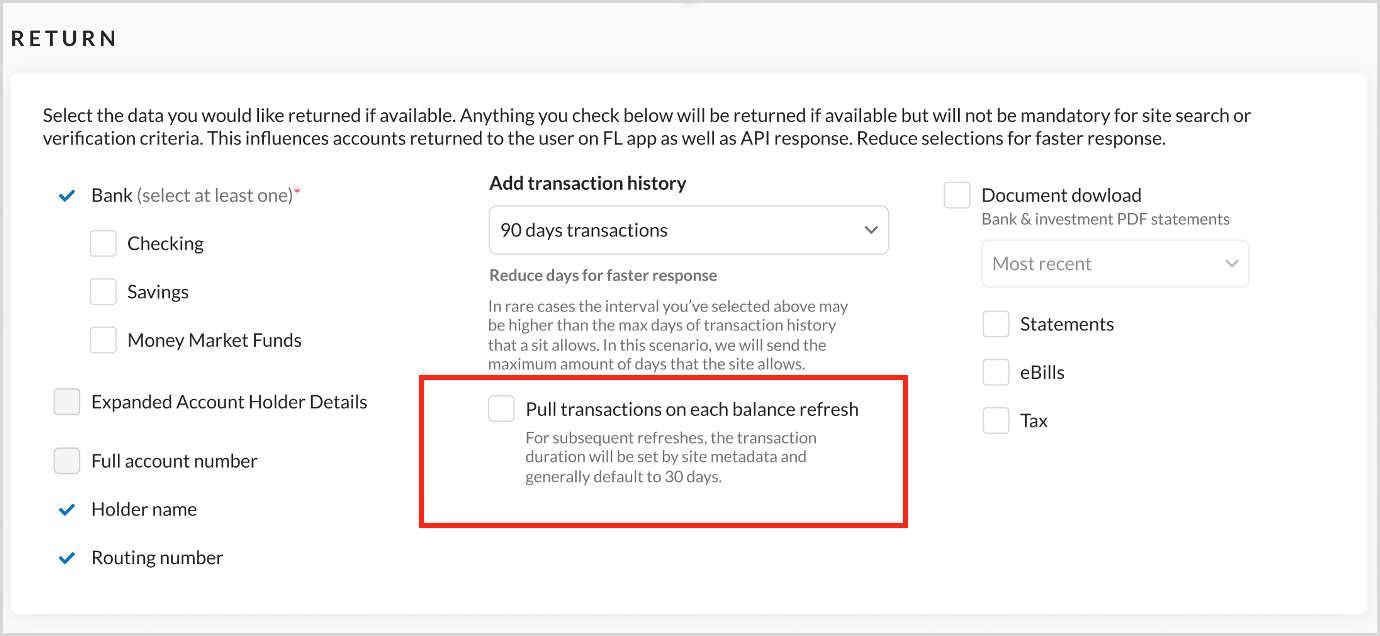

Ability to Pull Transaction History When Performing Balance Refresh

Some customers require the ability for the end users to refresh their account balances and retrieve transaction data. With this update, FastLink 4 will honor the transaction interval selected within the configuration tool and pull transaction data for the selected number of days when initiating the balance refresh flow. Previously, transactions were not honored during the balance refresh flow.

- This feature applies only to Verification customers who have also enabled transactions.

- By default, this feature is turned OFF. To enable this feature, click Set preferences on the Configuration Tool and view the RETURN section. Select the Pull transactions on each balance refresh checkbox under the Add transaction history section. Click Save and re-publish.

- The balance refresh flow must be invoked and a configname has to be passed with this setting turned ON.

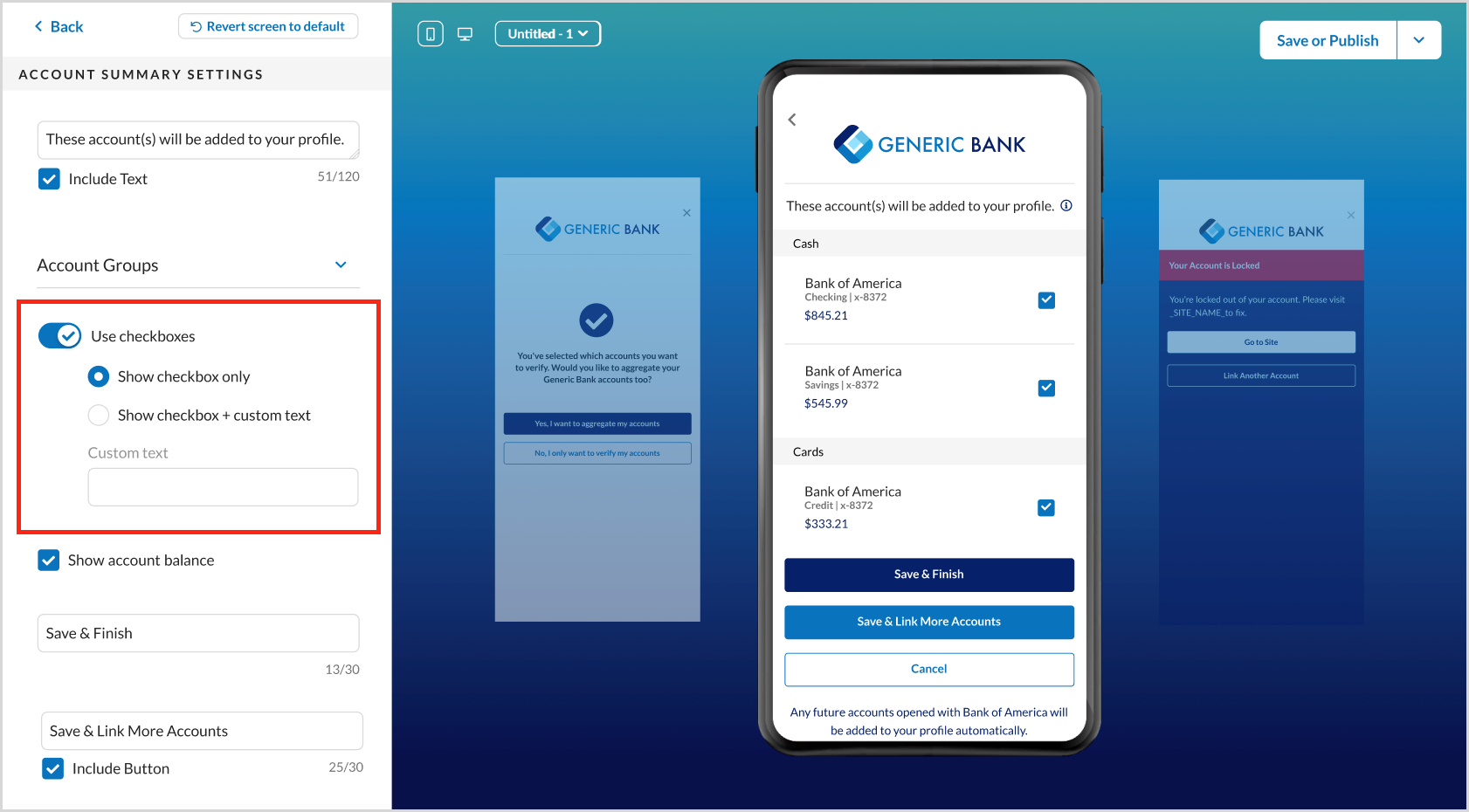

Aggregation Checkbox Configuration

The option to not display the checkboxes on the aggregation account summary screen has been provided in the Configuration Tool. Previously, this was NOT configurable, and checkboxes were always displayed next to each account, allowing the user to unselect or remove the accounts they did not want to save.

- Customers can turn the checkboxes OFF through a toggle setting in the Configuration Tool. By default, this toggle setting is ON.

- This option is only available on the Aggregation Account Summary screen which occurs in the Aggregation and unified flows.

- This setting is NOT available for Open Banking Account Summary screens.

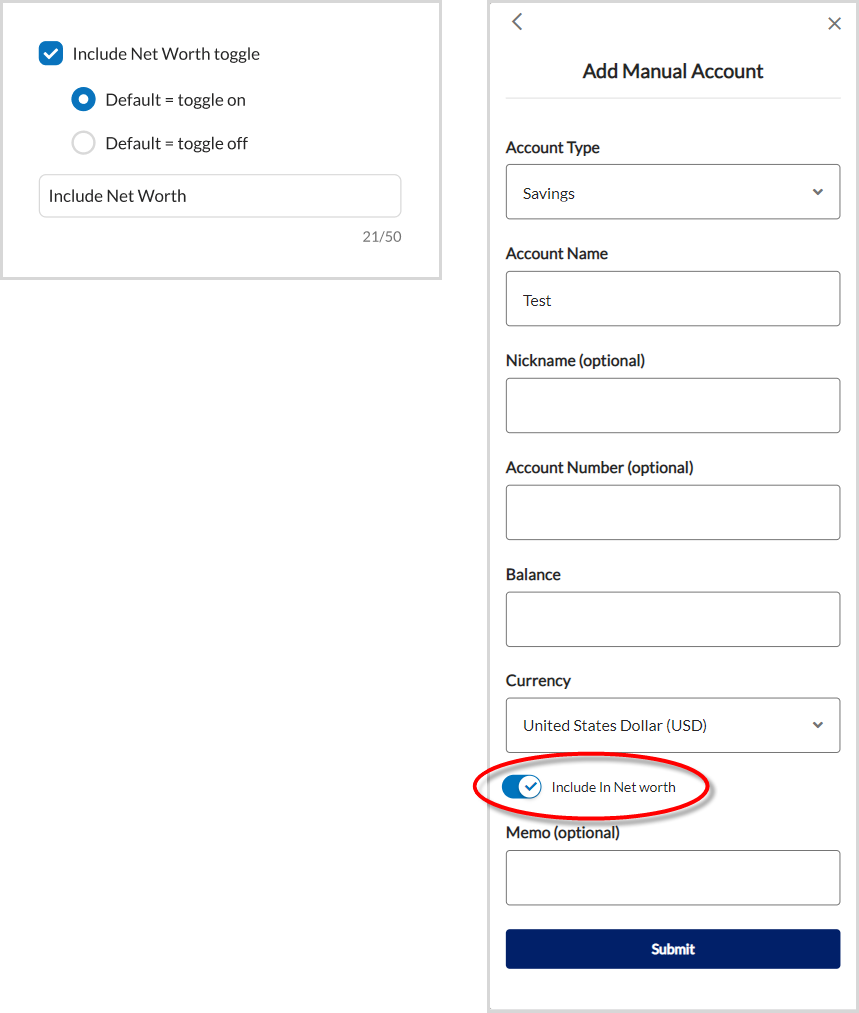

Net Worth Toggle Configuration

The ability to turn ON or OFF the Include in Net Worth toggle on the Add Manual and Real Estate FastLink screens has been introduced in the Configuration Tool.

- When the user adds their account with the Include in Net Worth toggle ON, that asset or liability will be included in their net worth calculations. By default, the toggle is included on the screen. This can be turned OFF in the Configuration Tool.

- The default state of the toggle is ON; this is also configurable.

- The display text of the Net Worth toggle can also be configured.

Account Verification – New Features/Enhancements

Verified Accounts API

The verified accounts API lets verification customers retrieve the verification request's status initiated in FastLink 4 and provides additional details of the verified accounts. The status of the verification request depends on the configurations done for the verification template in the FastLink Configuration Tool.

| API URL: |

CDV Webhooks

To improve the developer experience, a new webhook has been introduced to notify customers when there is a change in status of the user-initiated challenge deposit verification (CDV) requests. Customers should subscribe to the new event CDV_STATUS_UPDATES that is dedicated for this webhook. For more information, refer to Challenge Deposit Status Notification.

Open Banking – New Features/Enhancements

US Open Banking

FastLink 3 - Multiple Open Banking Applications Support

Support for FastLink 3 customers with multiple OB applications is now available. Required changes to component like onboarding, APIs, and other components have been done to provide end-to-end support for FastLink 3 customers.

FastLink 3 - Additional Configurable Text on Screen

To allow displaying customer configurable help text, enhancements have been done to the FastLink 3 credential-based - login page and OB consent page.

UK Open Banking – New Features/Enhancements

Yodlee AISP Services Engagement Model

Refresher and key upgrades to the Yodlee AISP Services model:

- The Yodlee AISP Services engagement model was only offered to enterprise customers by October 2021. From December 2021, the support has been extended to the Yodlee Developer Portal customers as well.

- The Yodlee Governance team’s decision will be final and binding whether the customer is a Registered AISP or is eligible for the Yodlee AISP Services engagement model.

- Customer onboarding and approval is available through automated workflow. Governance review process will be offline and will be coordinated through the sales team.

- Manual provider registration currently will be done through the Yodlee Client Services team and will be self-serve in 2022.

- Customer can only opt for one model per Open Banking region.

- No pure-play API support is available and only FastLink 4 Single-Site Selection flow is currently available.

| Segment | Availability | Model |

|---|---|---|

| Enterprise customers | Available | Yodlee AISP Services |

| Developer Portal customers | Available | Yodlee AISP Services |

Registered AISP Engagement Model

Support for the Registered AISP engagement model has been rolled out in December 2021 to the Yodlee Developer Portal customers in addition to the enterprise customers that already existed.

| Segment | Availability | Model |

|---|---|---|

| Enterprise customers | Available | Registered AISP |

| Developer Portal customers | Available | Registered AISP |

AU Open Banking

Hard Deletion of User Data from FastLink

As per Australian CDR Compliance guidelines, the end-user is provided the ability to choose permanent deletion of their transactional data. An optional toggle button is provided in the application to control this preference. The Yodlee Platform has been enhanced to permanently-delete all transactional data should the user choose to do so in the application.

Updating CDR Policy Guidelines URL

The URL on the consent page is currently redirecting the users to the CDR Policy website. The URL has been updated to redirect users to Yodlee-hosted URL/content.

Removing ADR Number for Third Parties as a Mandatory Field

In the FastLink Configuration Tool, the Third Party ADR Number field has been replaced with an optional Third Party URL field during the onboarding flow. In the AU region, not all customers may be associated with a third party. The third parties, if associated, will not have any ADR numbers as they’re not the data recipients for the AU region.

Financial Wellness – New Features/Enhancements

Utilized Merchants and Utilized Categories API Enhancements

The following enhancements have be done to the utilized merchants and categories APIs:

- Amount spent field introduced – A new field

netAmounthas been introduced in both the API responses that will return the amount spent by the user at the merchant level and category level. - Account ID filter introduced – A new optional query parameter

accountIdhas been introduced to filter the result for the required account/s. - Sort the API response – The ability to optionally sort the response either by

transactionCountornetAmount(i.e., the amount spent) in ascending or descending order has been introduced in both the APIs.

| API URLs: |

Predicted Cash Flow API Enhancements

The enhancements done to the Predicted Cash Flow APIs are as follows:

merchantTypesupport introduced:- Create a predicted event/manual transaction with the

merchantTypeattribute. - Update a predicted event/manual transaction with the

merchantTypeattribute for manual transactions. - The

merchantTypefilter available in the GET resource APIs for predicted events, predicted transactions, and manual transactions. - The GET resource APIs for predicted events, predicted transactions, and manual transactions will return the

merchantTypeattribute when the field is present.

- Create a predicted event/manual transaction with the

detailCategoryIdanddetailCategoryNamesupport introduced:- Create a predicted event/manual transaction with the

detailCategoryIdattribute. - Update a predicted event/manual transaction with the

detailCategoryIdattributes for manual transactions. - The GET resource APIs for predicted events, predicted transactions, and manual transactions will return the

detailCategoryIdanddetailCategoryNameattributes if the fields are present.

- Create a predicted event/manual transaction with the

API URLs:

Predicted events APIs:

POST /predictedEvents

PUT /predictedEvent

PUT /predictedEvent/{predictedEventId}

GET /predictedEvents

GET /predictedEvents/{predictedEventId}

Predicted transactions APIs:

GET /predictedTransactions

GET /predictedTransactions/{transactionId}

Manual transactions APIs:

POST /manualTransactions

PUT /manualTransactions/{transactionId}

GET /manualTransactions

GET /manualTransactions/{transactionId}