FastLink and Configuration Tool – New Features/Enhancements

FastLink 4 UX Enhancements

To create a more intuitive and visually consistent experience for the end users, a series of UX improvements in FastLink 4 has been introduced. These updates demonstrate a continued commitment to delivering a modern, accessible, and user-centric experience. By aligning with UX best practices, the goal is to enhance user satisfaction and drive greater adoption across partner platforms.

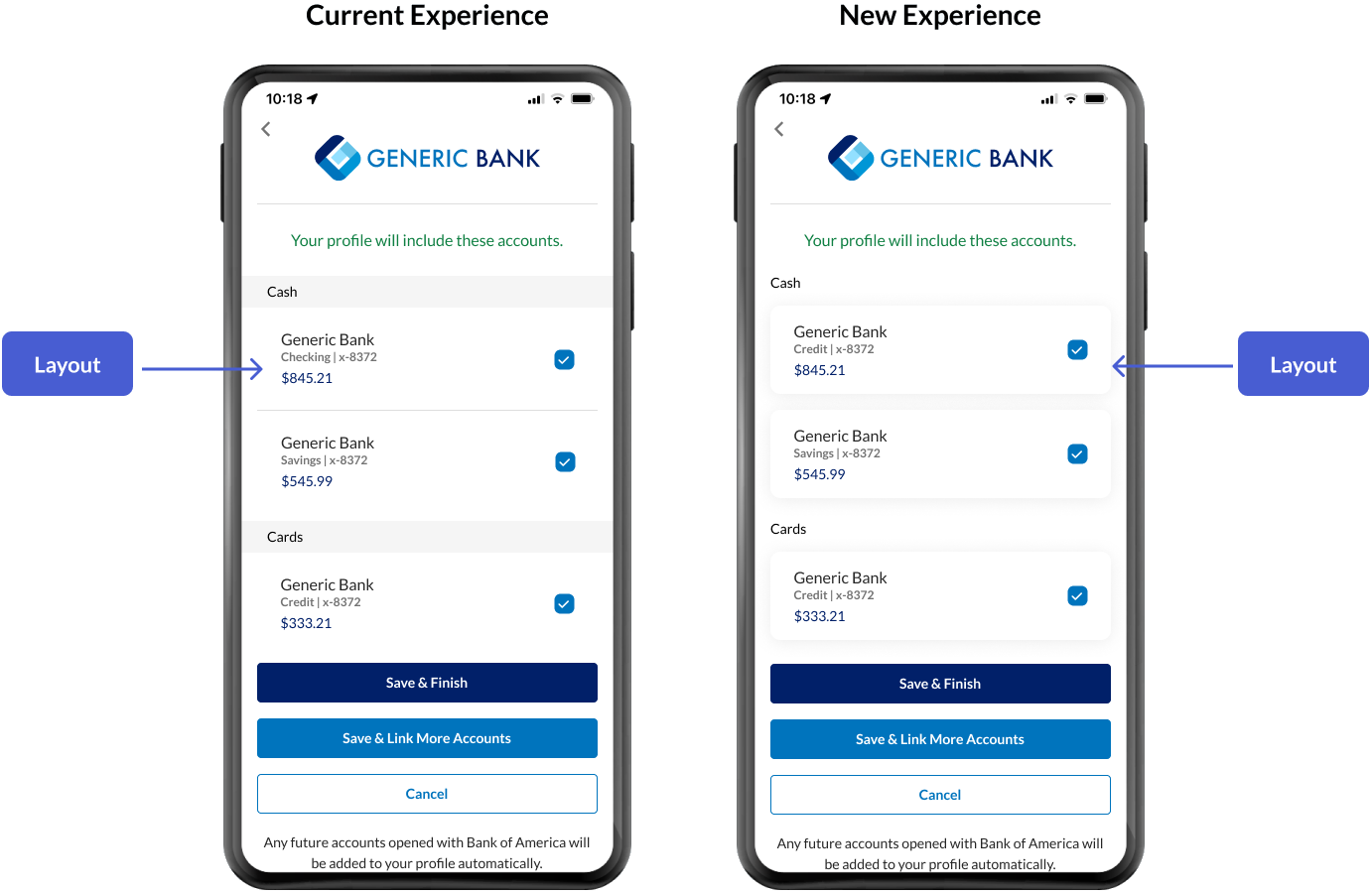

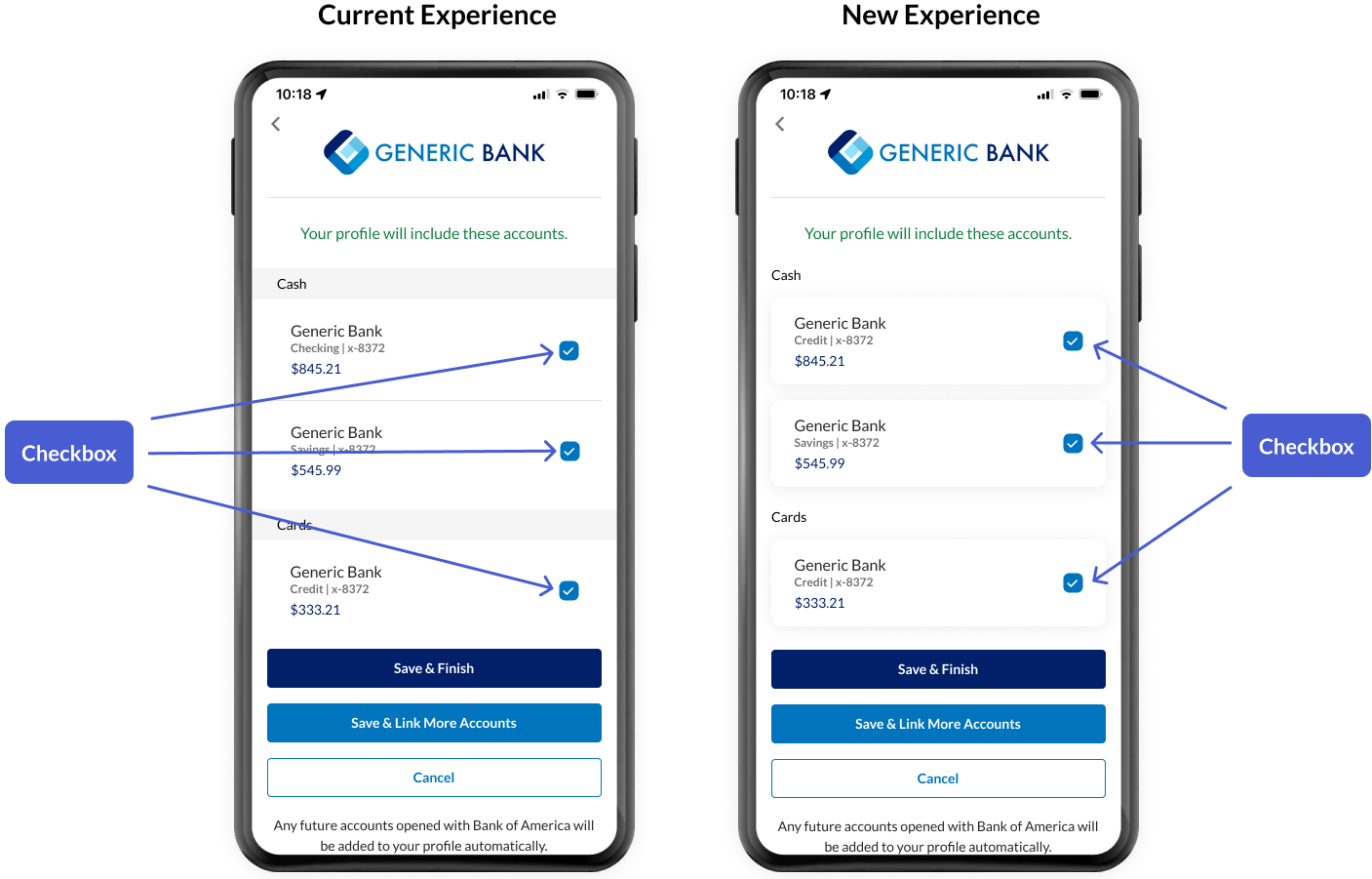

- Account Summary Layout –

The Account Summary screen has been updated with a redesigned list box layout to improve readability and make key information more distinguishable. This enhancement follows industry-standard UX principles, resulting in a more intuitive and efficient user interface.

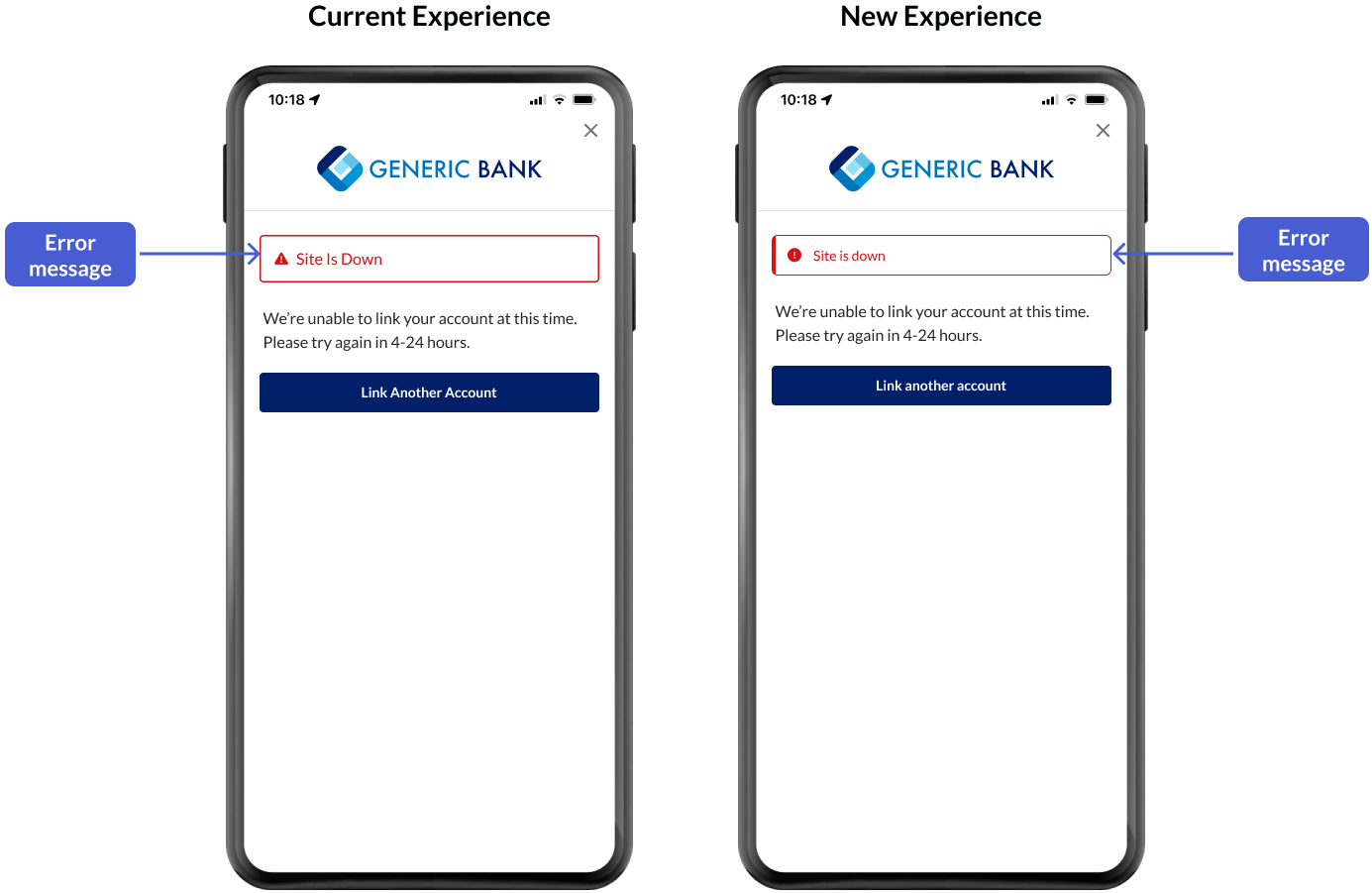

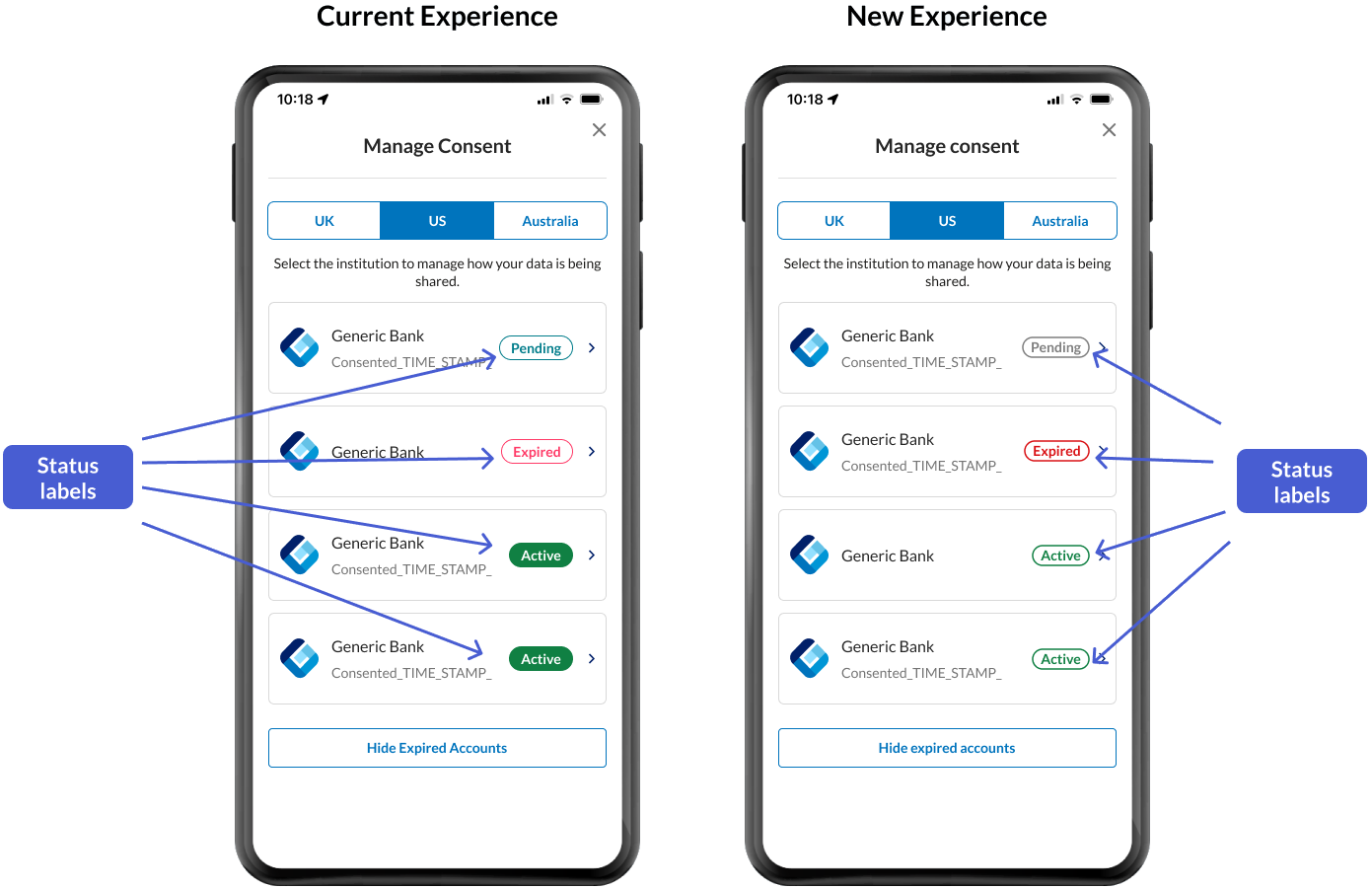

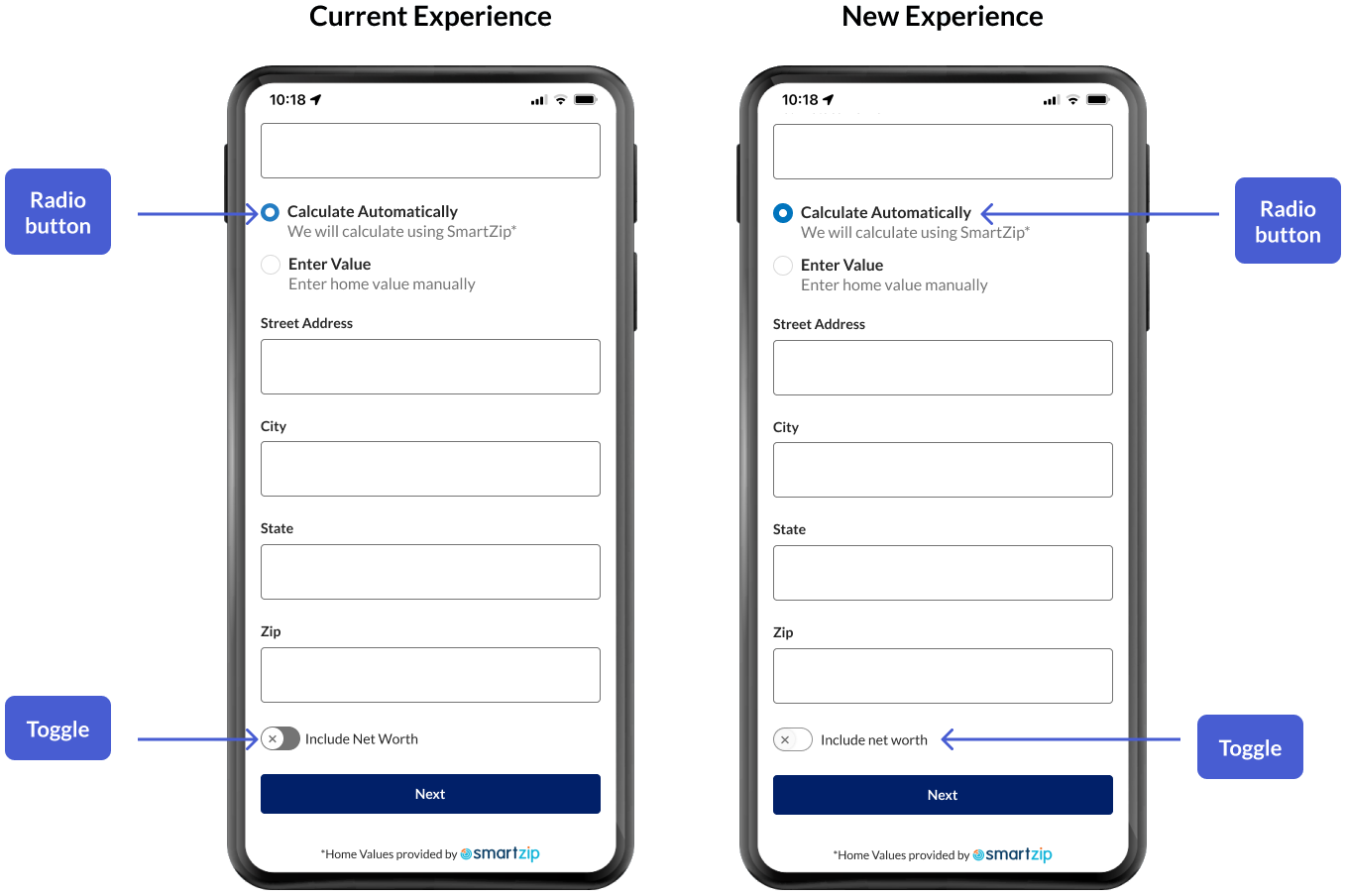

Enhanced UI Elements –

Error messages, status labels, toggle switches, radio buttons, and checkboxes are now visually standardized across all supported versions, ensuring a consistent and seamless user experience.

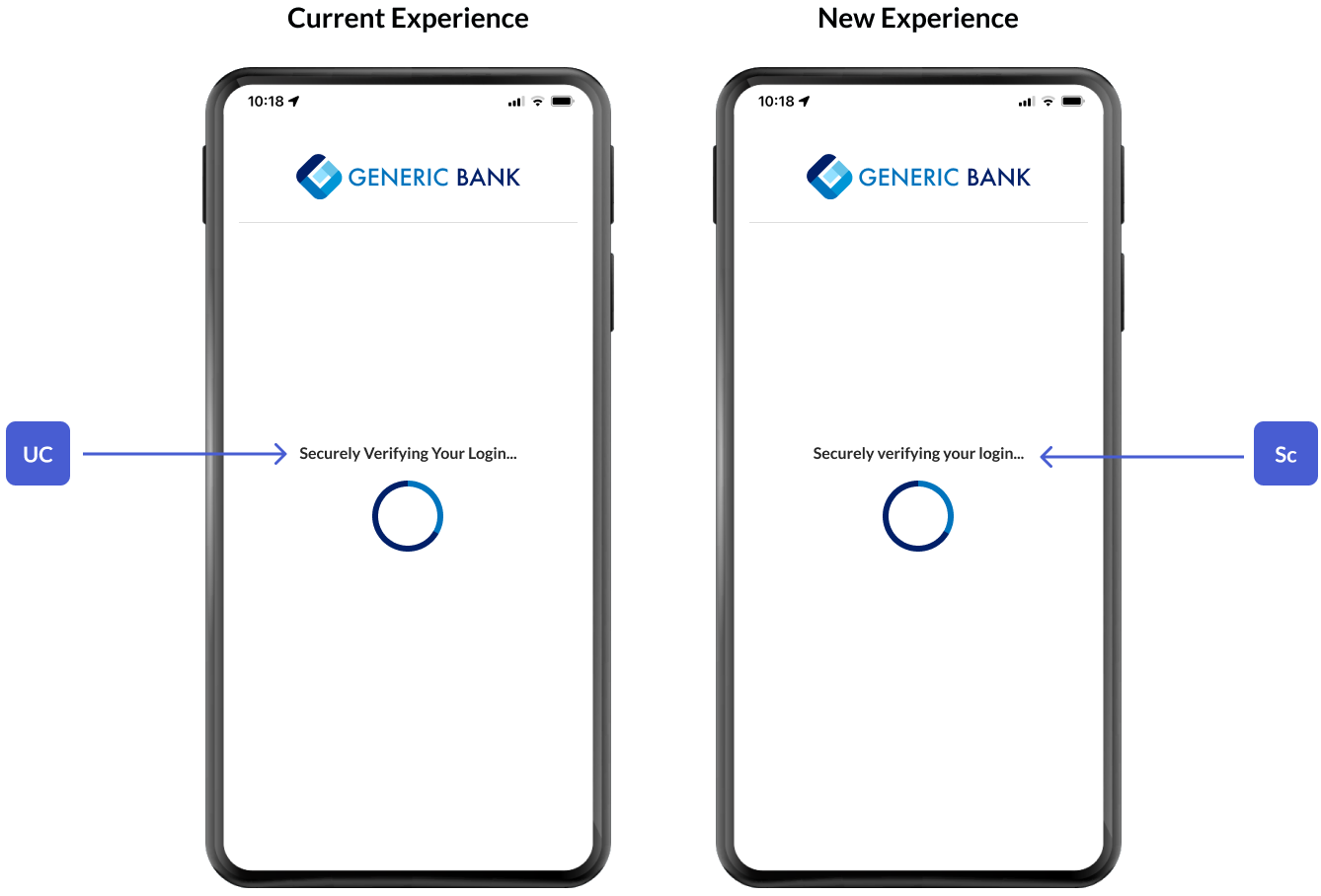

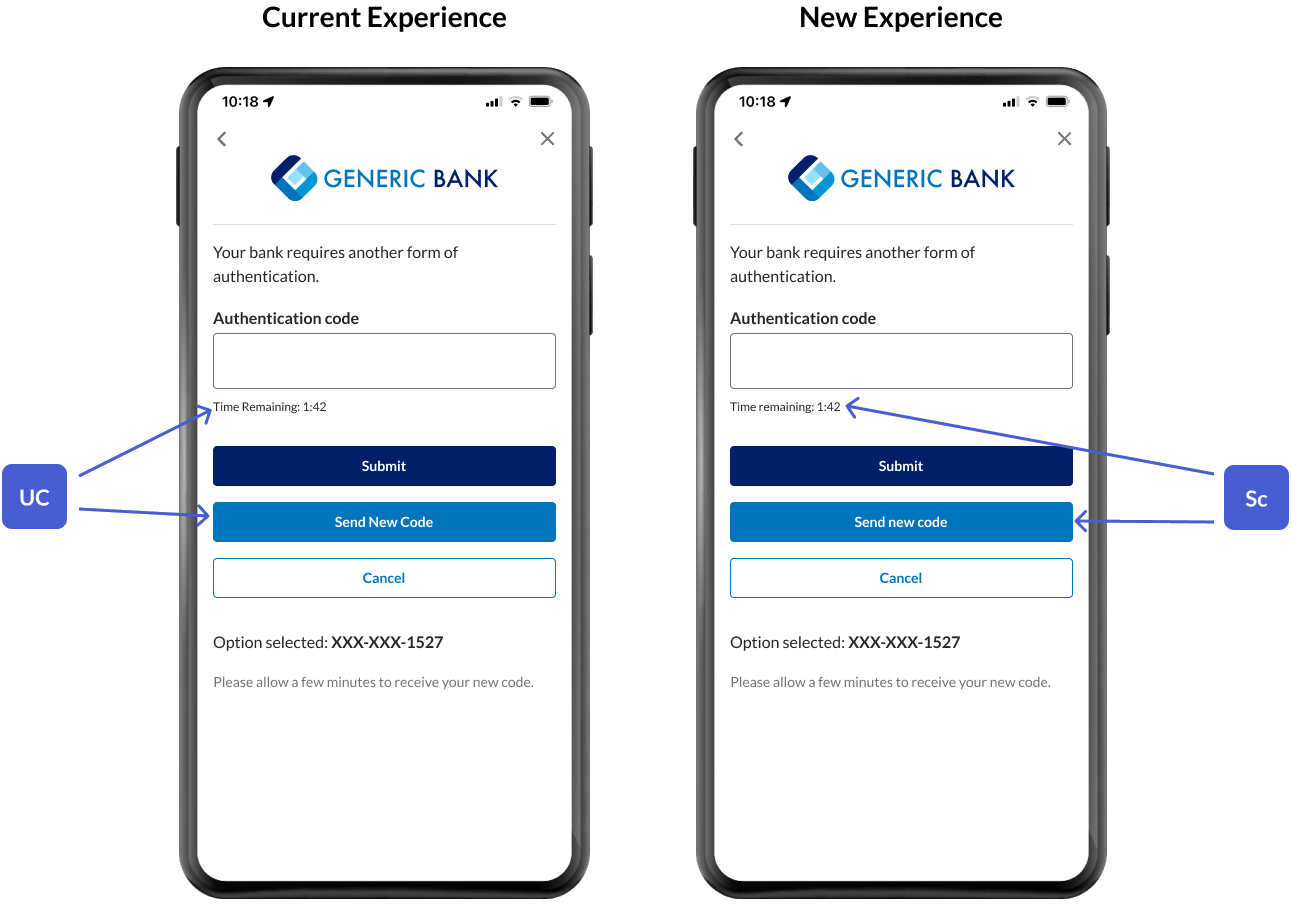

Standardized Label Formatting –

All UI labels now use sentence case such as those on buttons, page titles, and transition screens—enhancing readability and contributing to a more refined interface.

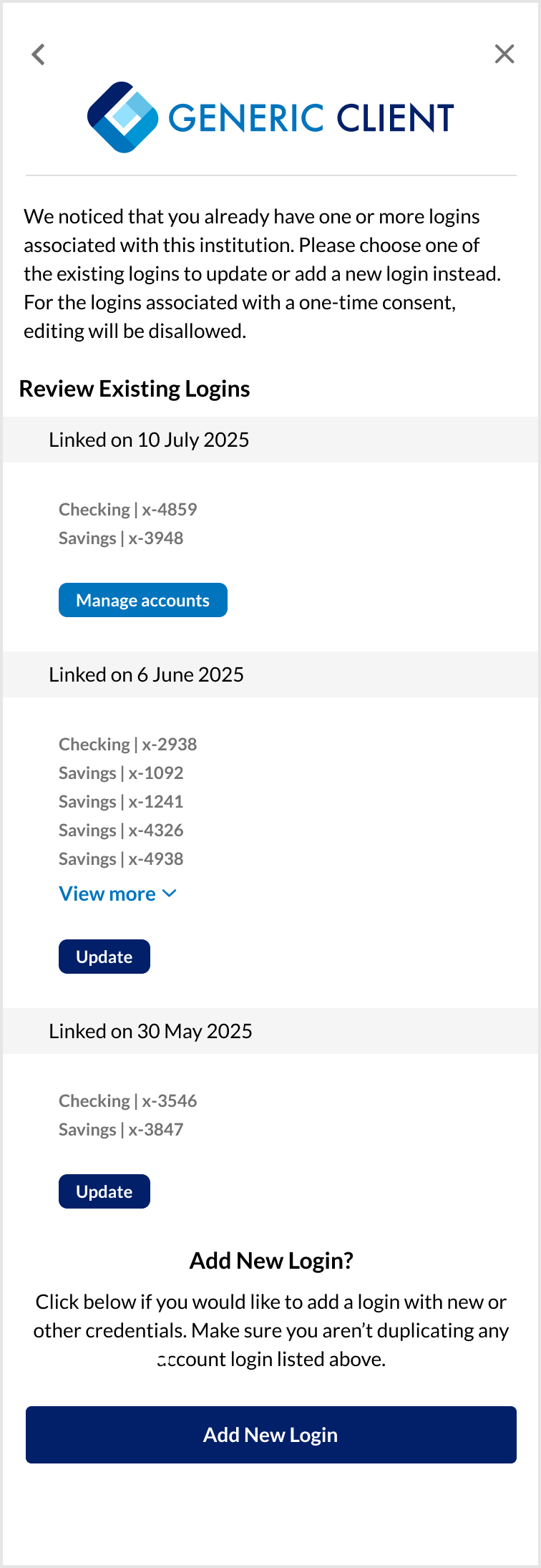

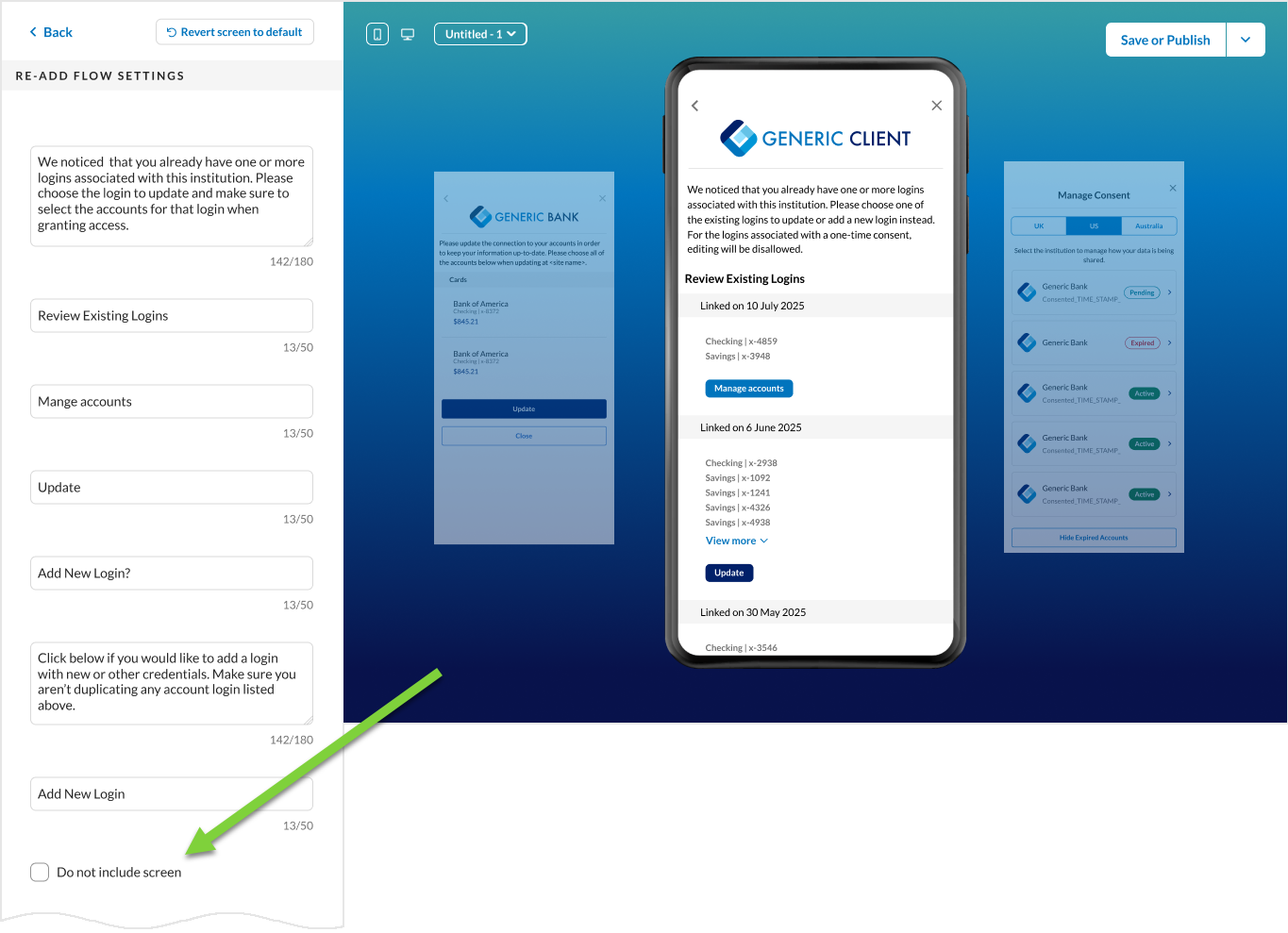

Re-add Screen Removed from Open Banking Consent Flows

To enhance and simplify the Open Banking consent experience for the Account Verification product flow, the Re-add screen has been removed by default for all new configuration instances for FastLink 4 customers. Since the Account Verification flow is typically a one-time event, eliminating this intermediate step helps reduce friction and improve the user journey.

This update is specific to the Account Verification flow and does not impact other product flows such as Aggregation, Aggregation + Verification, or Verification + Aggregation.

To ensure continuity for existing customers, the Re-add screen will remain enabled for all existing configuration instances. However, both FastLink 3 and FastLink 4 customers can choose to disable this screen. In the Configuration Tool, FastLink 4 customers can navigate to RE-ADD FLOW SETTINGS → select Do not include screen checkbox

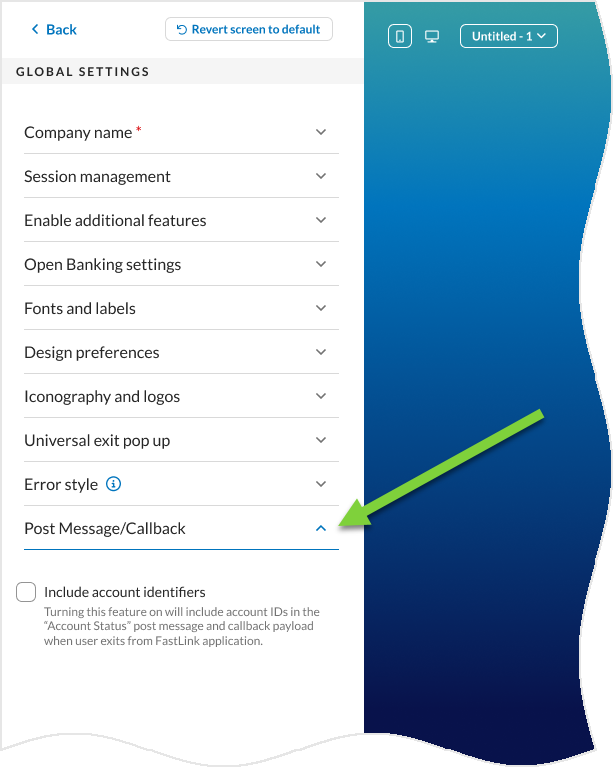

Post Message Enhancement

A new feature has been added to FastLink 4 that enables sending the accounts array in the post message. When enabled for the Aggregation product flow, this feature allows customers to receive the list of accounts selected by the consumer on the Account Summary screen after linking a new site. The selected accounts will be included in the post message upon exiting FastLink. This feature is also supported in the Aggregation + Verification product flow, provided the screen following the Account Summary screen is disabled.

If Account Classification is enabled alongside this feature, the post message will include both the accounts array and the userClassification object.

Sample post message -

{

"action":"exit",

"fnToCall":"accountStatus",

"sites":[

{

"providerId":16441,

"providerName":"Dag Site",

"requestId":"M+o58HIo+0K7dIEVaS5itYwgwz0=",

"status":"IN_PROGRESS",

"additionalStatus":"ACCT_SUMMARY_RECEIVED",

"providerAccountId":38679989,

"accounts":[

{

"id":99207972,

"userClassification":"PERSONAL"

},

{

"id":99207968,

"userClassification":"BUSINESS"

}

]

}

]

}

This feature is disabled by default and can be enabled through the Configuration Tool by navigating to GLOBAL SETTINGS → Post Message/Callback → selecting Include account identifiers.

AU Open Banking – New Features/Enhancements

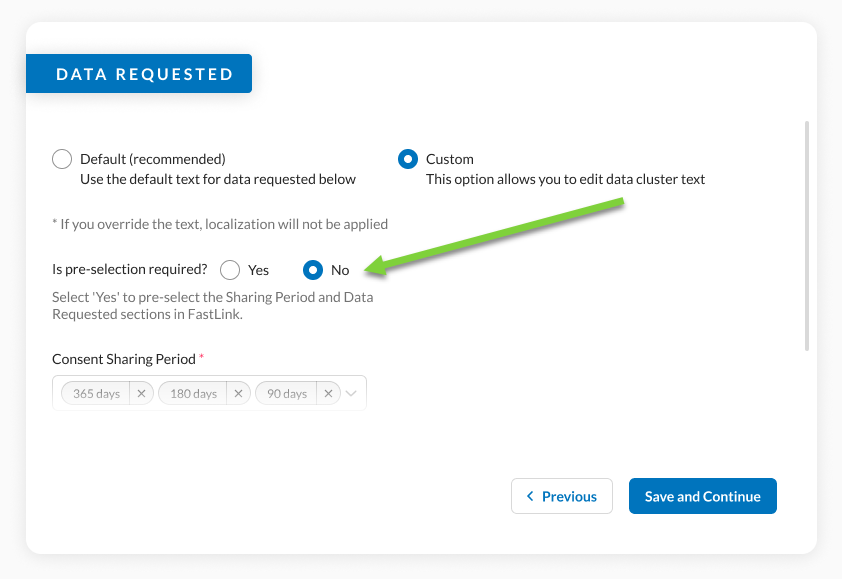

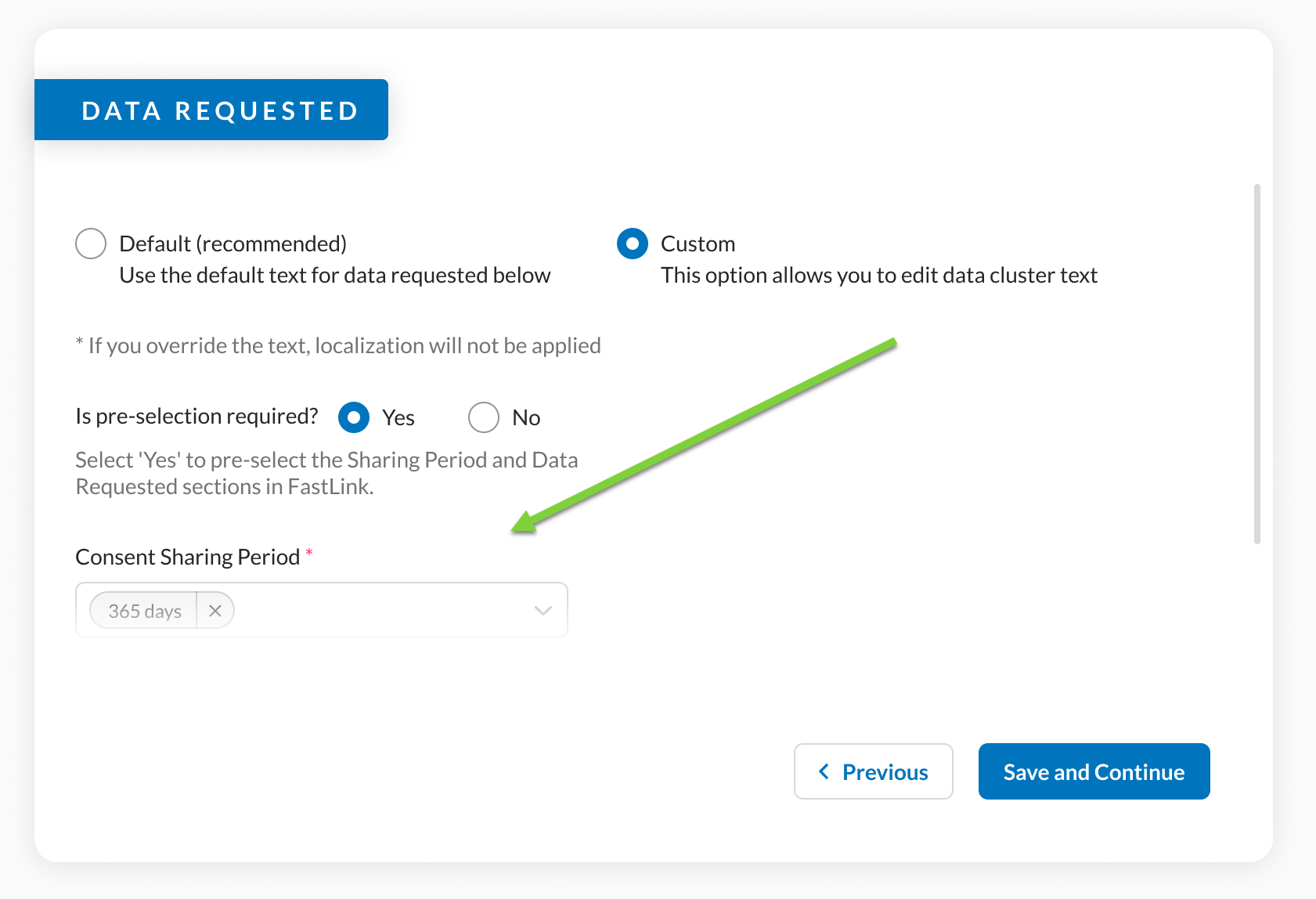

Consent Pre-selection Flow

In this release, configurability has been introduced, allowing customers to preselect options for the Sharing Period and Data Requested sections on the consent screen. Preselecting these sections through the Configuration Tool streamlines the consent flow by reducing the number of clicks and/or selections required for the consumer to make on the FastLink consent screen. Customers can choose the consent period and the data clusters/dataset as per their business needs.

The following updates have been made:

- In the Data Requested section of the Configuration Tool, the option to configure preselection has been introduced. By default, No is selected, and three durations from the Consent Sharing Period drop-down will have to be selected.

On selecting Yes, only one duration will be available for selection from the Consent Sharing Period drop-down.

The consent authorization and edit/renewal flows have been updated to honor the pre-selection settings configured for the OB application.

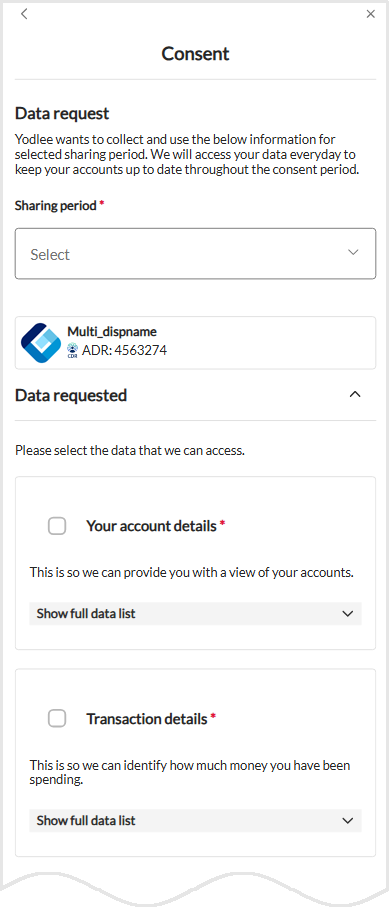

Pre-selection set to No

When the pre-selection configuration is set to No, the standard FastLink flow for recurring consents is followed. In this flow:- Consumers can select the Sharing Period from a drop-down menu.

- They can also choose data clusters/datasets via checkboxes in the Data Requested section.

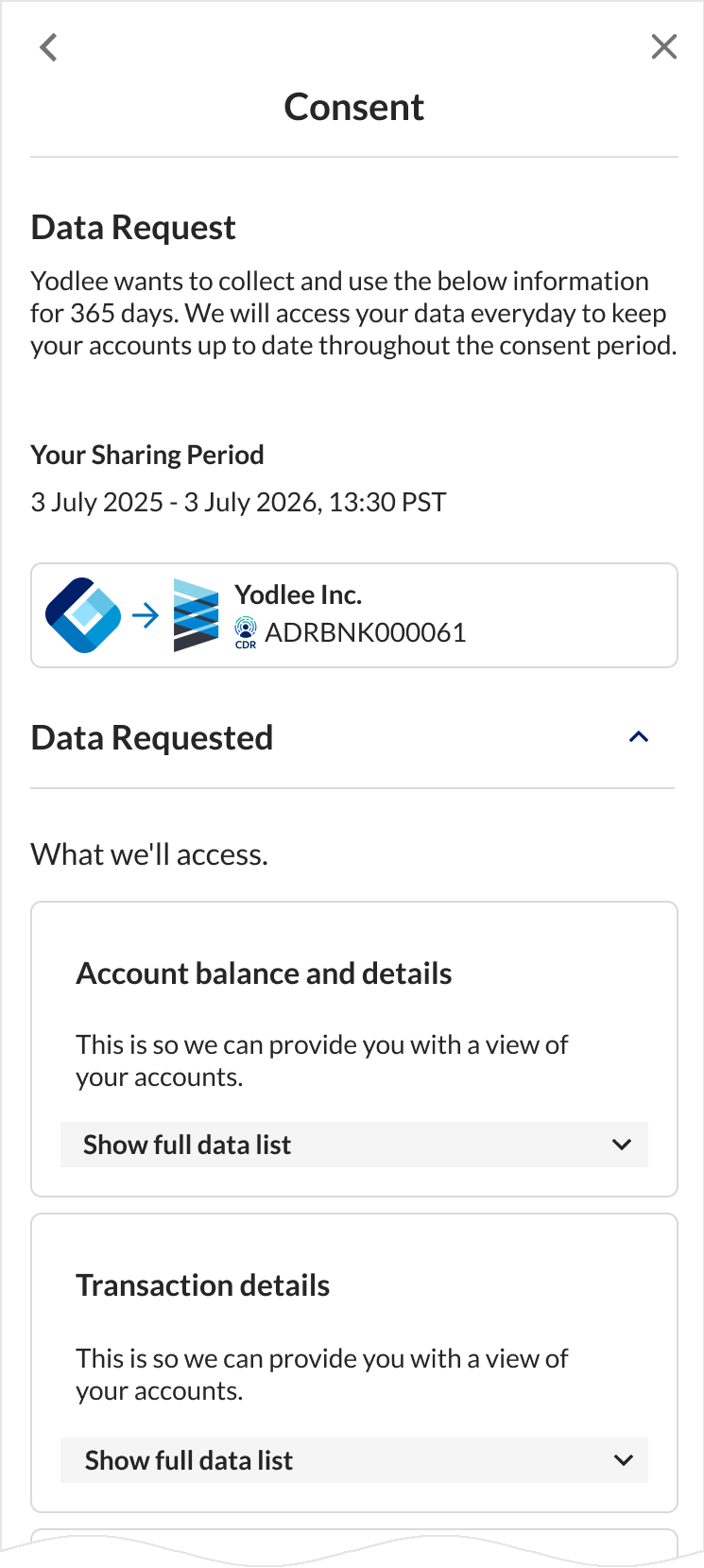

Pre-selection set to Yes

When the pre-selection configuration is set to Yes, the consent screen is simplified:- The Sharing Period drop-down is not displayed.

- The Data Requested section does not show checkboxes for data clusters/datasets.

Yodlee APIs – New Features/Enhancements

Fetch Transaction by ID and Source ID

This release introduces a new API that enables transaction detail retrieval using the Transaction ID as a path parameter and container as a query parameter. Additionally, the existing GET Transactions API has been enhanced to support Transaction Source ID as a query parameter. These enhancements streamline data access and simplify integration, enhancing the overall efficiency and user experience.

New API Method and URLs: GET /transactions/{transactionId}?container={container} |

Impacted API Method and URLs: |

Credit Matrix – New Features/Enhancements

Upload and Associate Supporting Documents

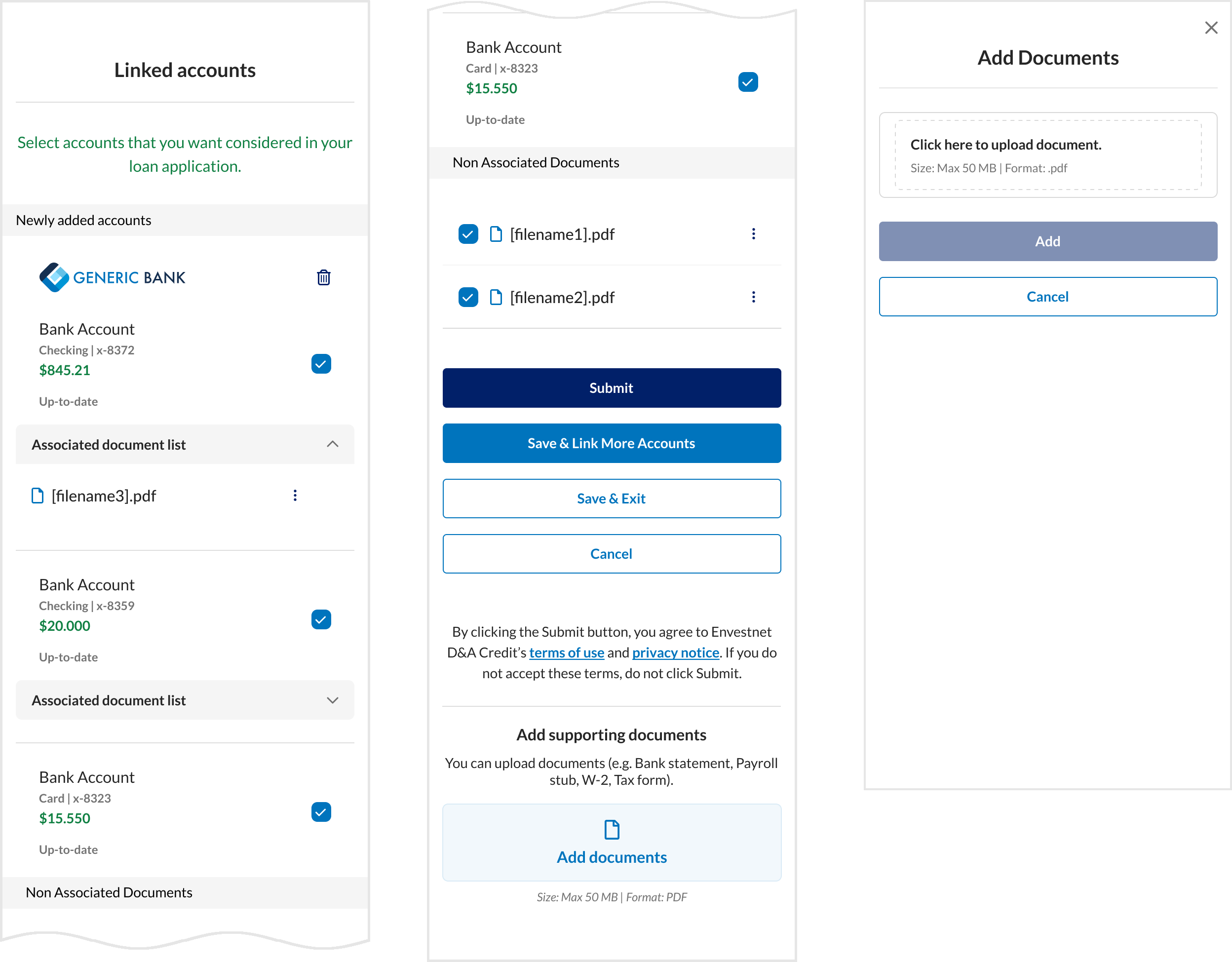

As part of the loan or mortgage application submission process through the Credit Matrix product, consumers link their bank or asset accounts. Yodlee aggregates this financial data and derives key insights required by lenders and underwriters to support loan approval decisions. Currently, a variety of datasets are provided to lenders, including assets, expenses, and account verification information.

There is growing demand for expanded datasets that build confidence during the loan application process. A key area of interest is access to documents such as paystubs and tax forms (e.g., W-2, 1099), and in this release, the Credit Matrix product has been enhanced to allow consumers to upload these supporting documents. These documents can be used for account ownership validation, fraud detection, employment and address verification.

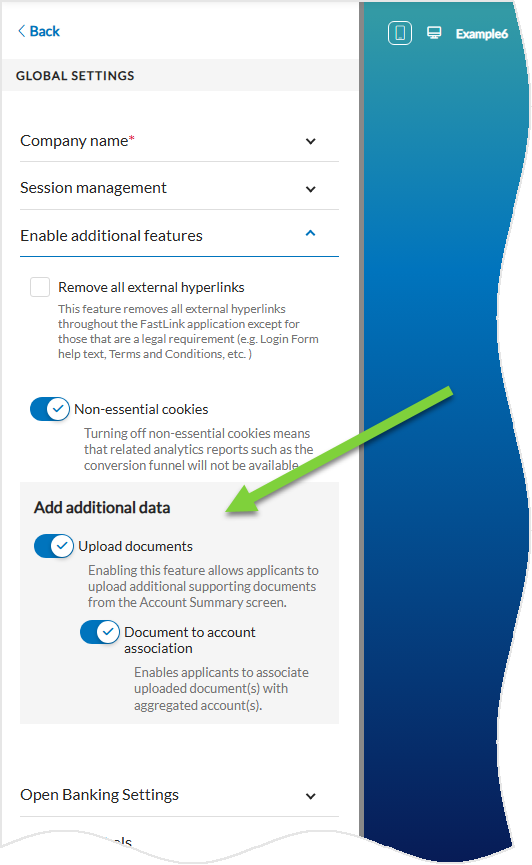

To enable this functionality, navigate to the Configuration Tool and go to: GLOBAL SETTINGS → Enable additional features → Add additional data section, then select the appropriate options.

Once this feature is enabled, consumers can upload supporting documents, associate them with existing aggregated financial accounts, and select unassociated documents, if any, and submit them for loan application through FastLink.

When consumers exit the FastLink journey, either by submitting the application or saving it for later, the post message sent to the customer will include both the uploaded documents and the selected accounts. Additionally, these documents can be retrieved via available APIs, offering flexibility and integration support for customer systems.

The Add Documents screen can be directly accessed by deep-linking with the parameter flow=uploadDocuments when launching FastLink. This allows for a more streamlined experience by taking consumers straight to the document upload step within the flow.

Account Verification – New Features/Enhancements

Generate Risk Analytics

The Account Verification service checks for any fraud pattern but does not derive any risk information with respect to the account. The risk analytics feature, introduced in this release, enables customers to gain deeper insights into potential risks associated with their consumers, helping them to identify, assess, and effectively manage those risks.

Risk analytics will be generated only for accounts verified using FastLink 4 Instant Account Verification service and not the Micro Entries service. Once account verification is complete, risk analytics for the selected account(s) will be initiated and made available in near real time.

Contact the Yodlee Client Services team to enable this feature, however, the plan to automate this feature is in the roadmap.

As part of this feature, the following new components have been introduced:

RISK_ANALYTICSwebhook –

Webhook will be triggered to notify the customer when the risk information is generated for the verified accounts. Click here, for more information about the Risk Analytics Event.GET Risk Analytics API –

The API retrieves the risk analytics information for the verified accounts.New API Method and URLs: