Getting Started

Account verification customers providing digital payment services can eliminate the risk of storing users' sensitive financial account information using Account Token endpoints. The endpoints allow customers to create an account-specific token that the payment processors can use to retrieve account information.

Our payment processor partners can use this token to retrieve the following account information to process payments:

- Account holder information such as name, email, phone number, address, etc.

- Account information including account name, account number, type, transfer code (for example, the routing number of the bank account in the US), etc.

- Account balance information.

Sign Up

For Customers

The Yodlee Client Services team can help you sign up. Contact Support

For Payment Processors

Sign up for the payment processor partnership program. Contact Sales

Sandbox Environment

For Customers

The Sandbox environment is available free once you register for a developer account. Sandbox comes enabled with five pre-configured users. It does not allow you to register new users. It is also restricted to using sample data for security reasons. Once you're comfortable and want to work with live transaction data, we recommend moving to the free Engage Tier. This guide assumes you are using the Sandbox environment.

For Payment Processors

Once you sign up to use our Account Token solution, you will receive a welcome mail containing your credentials and instructions on setting up and using the Sandbox environment.

FastLink

Account Verification starts with your user authenticating and selecting an account at any of the thousands of banks we support. To accomplish this, FastLink saves you from dealing with complex technical interactions and managing disparate user experiences to connect to and authenticate with those banks. FastLink also helps unify financial institutions that support Open Banking and those without a single managed experience, ensuring that your application always utilizes the most modern experience available.

The FastLink documentation provides many more details about FastLink and how you can use it to meet your requirements. The FastLink Demo will show you the user experience of linking accounts, while the Configuration Tool Demo will show you how you can customize FastLink to meet your requirements and match the look and feel of your application.

FastLink Documentation FastLink Demo FastLink Configuration Tool Demo

Introduction Videos

Start by viewing these videos to help prepare you to start building your FinTech application.

Guide to the Yodlee Ecosystem

Key Terms

- Users - End users of your application. In other words, your customers.

- Providers - Data providers. The financial institutions, like banks, credit card companies, and so on.

- Provider accounts - This refers to the accounts your users use to access their provider information. For example, if a bank has a web portal, your user has to log in to an account to use it.

- FastLink - You need to connect or "link" your users to the accounts they hold. FastLink is an embeddable Yodlee tool designed to make this easy.

- Accounts - This refers to your users' accounts, like a checking or savings account, held by a provider.

Typically, you'll be working with three different account types:

- Provider accounts - These are the accounts your user and, through Yodlee, you use to access banking, investment, and other financial services provider information.

- Financial accounts - These are the traditional accounts like checking, savings, credit card, loan accounts, and so on.

- Application accounts - These are the accounts you create to track and provide services to your customers.

- Processor token - The unique token that the payment processor can use to make API requests to the Yodlee system to retrieve account information to process payments.

Prerequisites

For Customers

To complete this guide, you'll need to:

- Register for a developer account.

- Get your credentials from your API dashboard.

- Pick one of the 5 pre-registered test users to work with.

For Payment Processors

Sign up to use our Account Token solution and receive your credentials to access our APIs.

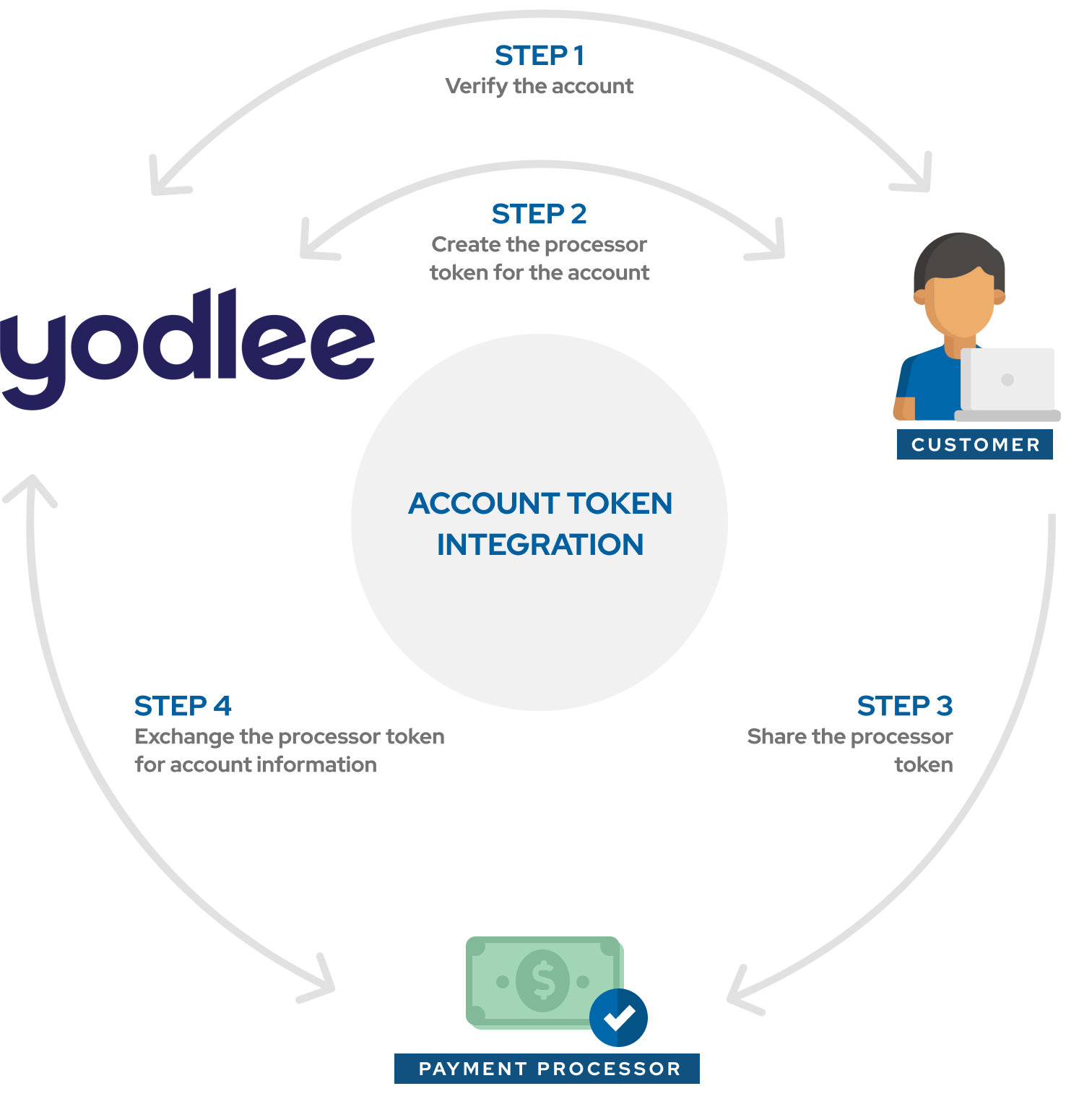

Integration Process

For Customers

Step 1 - Verify the financial account

Use FastLink to verify the user's financial account and retrieve the account ID.

Step 2 - Create the processor token for the account ID

Create a secure processorToken for the user's verified financial account using the Create Account Token API.

Step 3 - Share the processor token with the payment processor

Connect with your preferred payment processor for the steps specific to passing the generated processorToken to them.

For Payment Processors

Step 4 - Exchange the processor token for account information

Use the Payment Processor APIs to retrieve account information by passing the processorToken.

Step 5 Optional - Make a call to the GET balance service

Before initiating a payment, confirm funds' availability by passing the processorToken in the GET account balance API.

Start Coding Using Postman

Once you understand the basics from above and have completed the prerequisites, follow along in our Postman Quick Start Guide, which provides several step-by-step modules to quickly introduce developers to the necessary parameters, API calls, and sample code.

COMING SOON!